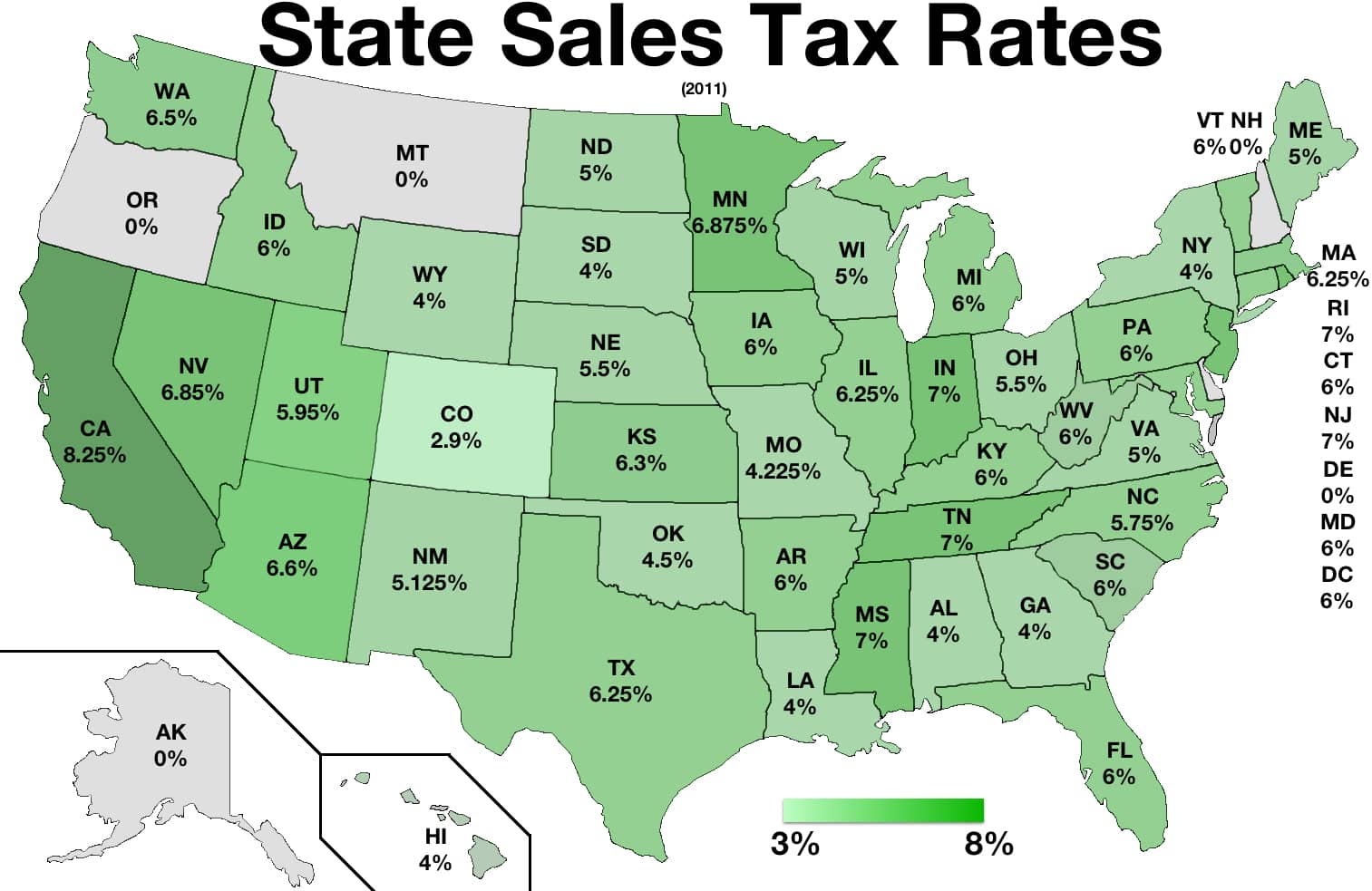

Determining, calculating, and collecting sales tax on individual products is crucial for an eCommerce business owner to avoid legal penalties and effectively operate an online marketplace. Every state/country imposes separate tax charges on the sale or purchase of products in the region. For instance, in Colorado, each transaction on Amazon.com includes a 2.9% sales tax fee while in Illinois, a 6.25% base tax rate + city tax is levied on similar purchases.

For an online business to successfully penetrate the market across borders, incorporating taxes on individual products in the marketplace becomes fairly crucial. There are two commonly adopted tax structures in eCommerce business:

- Single tax structure: Where the entire tax is imposed as one value. A single taxation system is one where no further bifurcations are done on the tax value. VAT (Value added tax), for instance, is one such example of a single tax structure.

- Combined Tax Structure: It is an aggregate of individual tax components. For instance, GST (Goods and Services Tax) in India is a combination of SGST, CGST, and IGST taxes. The combined tax structure is designed to support multi-tier tax regimes such as Canadian tax or the Indian tax system.

Sales Tax rates vary from state to state (county to county), especially in countries like the USA, where the states may charge taxes on purchases of goods from vendors with or without a physical presence in the state, according to the US supreme court decision on South Dakota v. Wayfair Inc. case.

The judgment made by the Supreme Court (on June 21, 2018) overturned the longstanding decision in Quill Corp. v. North Dakota (1992) case that barred states from collecting taxes on sales made by retailers without any physical presence in the taxing state. Since the Wayfair decision, the majority of US states have defined new rules on sales and tax obligations (known as nexus). And unfortunately for eCommerce retailers, no two states have the same sales tax nexus.

Here is a breakdown of the sales tax rates in 50 US states for which both TaxJar and Avalara API offer apt compliance solutions.

Sales Taxes in the US

Tax Compliance Challenges In eCommerce Marketplaces

Ensuring sales tax compliance in different states is a complicated yet crucial step for an eCommerce seller to streamline operations. There are several compliance challenges that a business must consider when creating an online sales strategy. Below we have listed some of the most notable challenges:

- Use of Tax rate tables

According to a report by Vertex, a total of 592 standard sales tax rate updates were recorded in 2020, taking the combined average sales tax rate across the US to reach a 10-year high. In total, there are over 13,000 tax jurisdictions with multiple jurisdictions applicable even within the same zip code in the US. So, sellers relying upon tax rate tables (based upon zip codes) could be charging incorrect tax rates on products unknowingly, since these tables tend to list the highest possible tax rate for a given zip code.

- Product Taxability

The ability to determine which items are taxable and which aren’t is a big help during sales tax compliance. From shipment handling to exempt sales, there are several areas where inaccurate product taxability might hamper an eCommerce business. Since tax compliance varies greatly in states as well as internationally, identifying correct rates prevents a business from under/overcharging customers.

- Processing Returns

Returns are an equally important process of the entire supply chain logistics. For eCommerce businesses to operate effectively and boost consumer satisfaction, streamlining returns is a must. Processing and refunding the correct sales tax amount helps keep your business in compliance.

Why Are TaxJar And Avalara APIs Preferred As Tax Service Integrations?

- Top-rated: With a real-user satisfaction score of 90 and 74, respectively, TaxJar and Avalara are among the highest-rated sales tax compliance software, according to G2.

- Accurate: Both software deliver extensive tax compliance solutions and perform millions of sales tax calculations accurately and in real-time.

- Automated updates: Any tax rate updates at the state, city, or district level are automatically incorporated into the eCommerce marketplace.

- Global support: While TaxJar supports tax rates in the US, Canada, Australia, and the European Union; Avalara API supports tax rates in 79 countries ensuring a truly global tax compliance solution for marketplaces.

- Trusted: Top commercial modern-day giants trust both TaxJar and Avalara. For instance, TaxJar is trusted by Coca-Cola, Quimbee, Microsoft, and many other modern-day giants. Similarly, Avalara offers automated tax compliance solutions to Pinterest, Zillow, Adidas, and other big corporates.

- Saves time and resources: Both software automate sales tax management in eCommerce marketplaces so the owners can focus on core business processes without worrying about regulatory non-compliance concerns.

- Managing returns: Both software offers automated solutions to prepare and file sales tax returns.

TaxJar And Avalara Tax Management APIs Pre-integrated In Yo!Kart

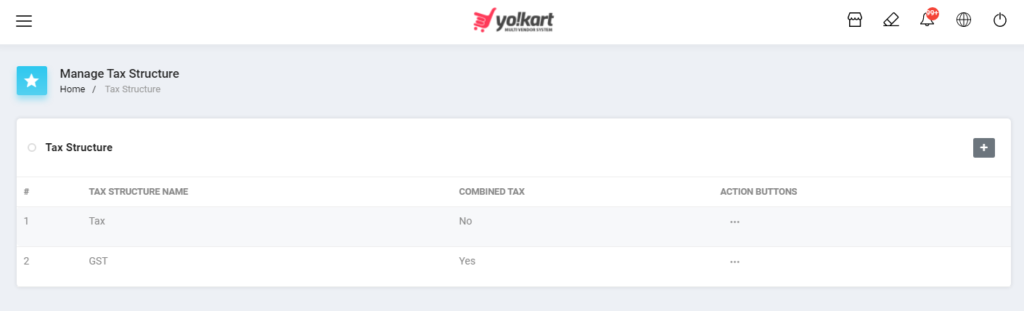

Yo!Kart is certainly among the leading multi-vendor eCommerce platforms. It comes with an in-built tax management module that empowers business owners to define the tax structure and rate on individual product categories.

Single and Combined Tax Structure

Prior to the latest release of Yo!Kart, sales tax for individual product categories could only be entered manually by the admin in a Yo!Kart-powered marketplace. To ensure hassle-free sales tax calculations and streamline tax management in eCommerce marketplaces, the team has integrated the powerful tax service APIs – TaxJar and Avalara in Yo!Kart V9.3.0. This ensures that your business isn’t falling behind on taxes.

How Does The Sales Tax Compliance Process Work In Yo!Kart?

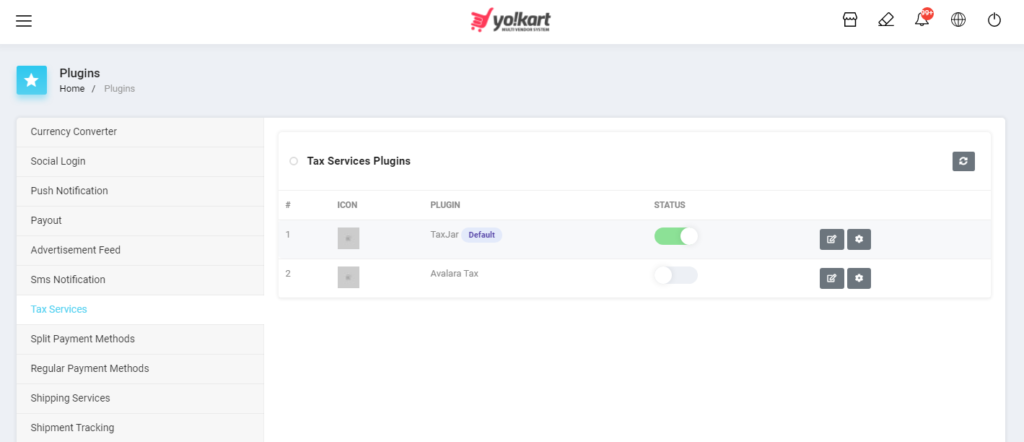

To automate sales tax compliance in Yo!Kart, the admin needs to activate either of the two pre-integrated tax service APIs. Go to Tax Services under System Settings -> Plugins in the admin dashboard to enable the service.

Once activated, the sales tax process in Yo!Kart works this way:

- Admin creates a tax structure (single or combined) under Manage Tax Structure in the dashboard.

- Tax management module synchronizes with the enabled/configured tax service API and automatically displays categories linked with the API

- Admin/seller links products with the listed tax categories

- Next, during check-out, the sales tax is applied based upon the buyer’s shipping address

- Once the transaction is complete, the admin collects and remits sales tax in the state

The admin can also use the in-built tax management module (in case neither of the APIs is enabled) to enter tax categories or set/change tax rates manually. This ensures streamlined marketplace operations while incorporating sales tax compliance effectively.

For complete working of the sales tax process, check out our admin manual.

Have additional queries on automated tax compliance in Yo!Kart?

Frequently Asked Questions

Q1. What is tax automation?

– Utilizing software solutions to ensure compliance with critical tax processes and automate decisions on tax transactions is termed as tax automation. It helps businesses automatically cover different tax regulations in various states/regions around the world with improved accuracy and overall efficiency. Tax automation is an instrumental part of e-commerce businesses looking to sustain and scale their business.

Q2. How do taxes work with eCommerce?

– For each state/country, sales tax may vary for all transactions (including e-commerce) that occur in the region. These taxes are added to the individual sales transaction and collected by the admin that pays these taxes to the government. Since there are separate taxes for every state and region, e-commerce businesses use tax management services to automate tax compliance.

Q3. What are TaxJar and Avalara used for?

– TaxJar and Avalara are two prominent tax service integrations that automate sales tax compliance for businesses such as an online marketplace. They deliver extensive, accurate, and real-time automated tax compliance solutions. Both Taxjar and Avalara APIs come pre-integrated in Yo!Kart to streamline tax management for marketplace operations.

Q4. Who uses TaxJar and Avalara API Integrations?

-Online marketplaces and e-commerce stores with businesses in multiple states as well as globally, require the use of TaxJar and Avalara API integration. This saves them considerable business hours that can be used to run, manage, and scale their operations.

Q5. How do you integrate TaxJar and Avalara in Online Marketplaces?

-Integrating TaxJar and Avalara APIs in online marketplaces depends upon their infrastructure and scalability. Yo!Kart, on the other hand, delivers a ready-made marketplace with TaxJar and Avalara APIs pre-integrated. To check/configure these tax service APIs in Yo!Kart, go to System Settings > Plugins > Tax Services in the admin demo.