Published date 18th Dec 2025

The global energy landscape is experiencing a fundamental shift, driven by an urgent need for sustainable solutions. As the governments, businesses, and investors accelerate their move toward sustainable solutions, the demand for renewable energy infrastructure, from solar farms and wind turbines to advanced energy storage, is increasing. This massive transition creates a compelling opportunity for innovative digital platforms.

One such opportunity is building a renewable energy asset marketplace, a specialized eCommerce platform that connects buyers and sellers of renewable energy projects, equipment, and related financial products in a structured, transparent environment. This blog serves as your comprehensive guide to understanding, planning, and successfully launching a profitable renewable energy asset marketplace in 2026 and beyond.

Table of Contents

- What is a Renewable Energy Asset Marketplace?

- Why is it Profitable to Build a Renewable Energy Asset Marketplace in 2026?

- Top Renewable Energy Marketplaces

- Trending Assets Driving the Renewable Energy Marketplace

- How to Build a Renewable Energy Asset Marketplace

- Things to Consider Before Building a Renewable Energy Asset Marketplace

- Yo!Kart: eCommerce Marketplace Software Solution

- Conclusion

What is a Renewable Energy Asset Marketplace?

A Renewable Energy Asset Marketplace is a specialized online platform that facilitates the buying, selling, leasing, or financing of renewable energy assets within the clean energy sector. Unlike a traditional eCommerce site for consumer goods, this marketplace typically handles high-value, specialized assets and complex financial instruments.

- Key Transactions: This includes the sale of utility-scale solar projects, operational wind farms, battery storage systems, green hydrogen facilities, and even financial products like Power Purchase Agreements (PPAs) or Renewable Energy Certificates (RECs).

- Participants: The platform connects a diverse group of users, including project developers, utilities, institutional investors, infrastructure funds, Independent Power Producers (IPPs), and corporate buyers seeking to meet their sustainability goals.

Essentially, it acts as a transparent, centralized hub that simplifies the complex process of financing, buying, and selling multi-million-dollar clean energy assets and their associated deal flow.

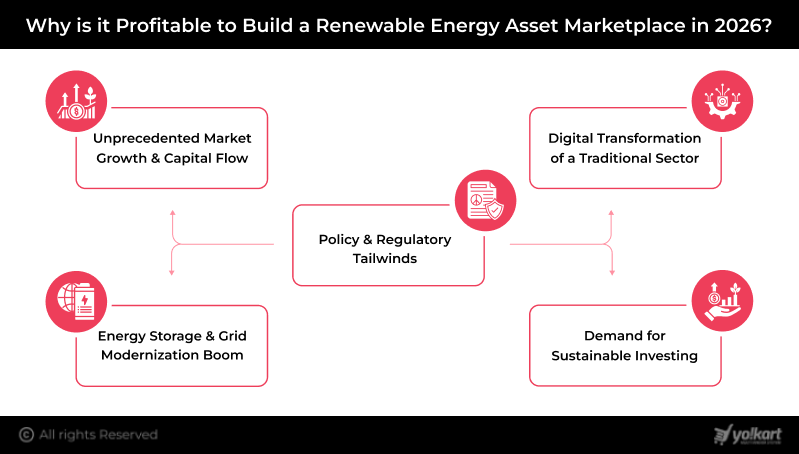

Why is it Profitable to Build a Renewable Energy Asset Marketplace in 2026?

Building a specialized eCommerce marketplace for renewable energy assets in 2026 presents a strong commercial opportunity. Moreover, it is poised for high profitability due to several converging global trends:

1. Unprecedented Market Growth and Capital Flow

The clean energy transition is accelerating. Global investment in renewable energy continues to reach new highs as governments, utilities, and private investors expand solar, wind, and energy storage capacity. The sheer volume of new capacity being deployed creates a massive need for platforms that can efficiently channel development capital and facilitate project acquisitions. This constant flow of high-value assets ensures a steady stream of transaction opportunities for a specialized energy asset marketplace.

2. Digital Transformation of a Traditional Sector

Renewable energy transactions have been manual, reliant on personal networks, and fragmented documentation. A digital marketplace offers transparency, speed, and efficiency. By digitizing due diligence documents, offering standardized project data, and providing tools for risk assessment, a marketplace dramatically reduces transaction costs and time, making it essential for market participants.

3. Energy Storage and Grid Modernization Boom

The profitability is further amplified by the rapid growth of energy storage. Advanced battery systems like lithium-ion and newer long-duration technologies are crucial for grid stability. These assets are capital-intensive and high in demand, making them ideal for marketplace-led discovery and investment. A marketplace specializing in solar-plus-storage or standalone Battery Energy Storage Systems (BESS) taps directly into this high-growth, high-value segment.

4. Policy and Regulatory Tailwinds

Supportive governmental policies worldwide, such as tax credits, emissions targets, and renewable portfolio standards (RPS), solidify the long-term demand for these assets. These policy frameworks de-risk investments and ensure a continuous pipeline of projects requiring capital and ownership transfers. For a marketplace, this translates into long-term relevance and predictable growth opportunities.

5. Demand for Sustainable Investing

Sustainable investing is no longer niche. Institutional investors, corporations, and even high-net-worth investors are actively seeking the assets that are focused on Environmental, Social, and Governance (ESG) criteria. A renewable energy asset marketplace provides a direct, measurable pathway for investors to deploy capital into measurable, impact-driven, sustainable assets, attracting premium liquidity and capital.

Together, these factors make 2026 an ideal time to build and scale a renewable energy asset marketplace that sits at the intersection of sustainability, technology, and finance.

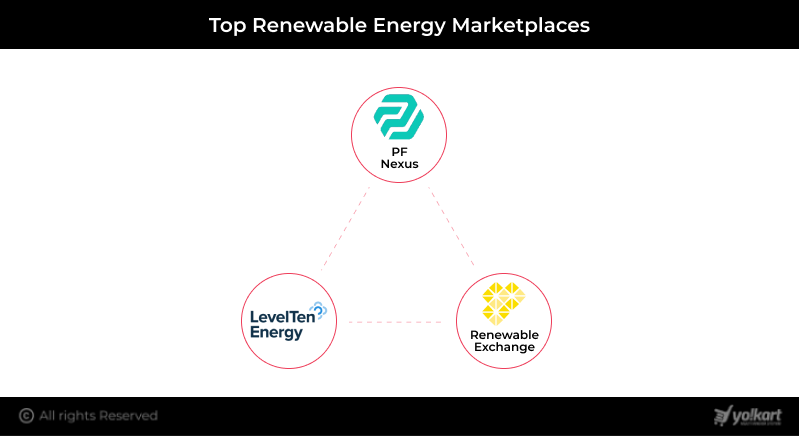

Top Renewable Energy Marketplaces

The current market landscape, while niche, clearly demonstrates the viability and long-term potential of renewable energy asset marketplaces. Leading platforms have succeeded by simplifying complex transactions and bringing together the right participants within a focused ecosystem:

1. PF Nexus: This platform primarily focuses on matching project developers with investors and financial advisors for project, portfolio, and partnership investment opportunities across all development stages (early-stage, ready-to-build, and operational). PF Nexus is designed to facilitate strategic partnerships, portfolio investments, and capital deployment with greater efficiency.

2. LevelTen Energy Marketplace: LevelTen Energy specializes in Power Purchase Agreements (PPAs), providing a two-sided platform that connects renewable energy generators with corporate and utility buyers, offering advanced analytics to compare PPA offers and risks. This data-driven approach helps buyers make faster, more informed procurement decisions.

3. Renewable Exchange: Focuses on transparently connecting renewable energy generators to a wide market of buyers for Power Purchase Agreements, often in specific regional markets like the UK. It helps standardize PPA procurement and improve price discovery.

These examples highlight a clear pattern behind successful renewable energy marketplaces. A sharply defined focus, deep industry expertise, and robust technology are the key factors that drive adoption, trust, and sustained growth.

Launch a Specialized Marketplace for Clean Energy Assets

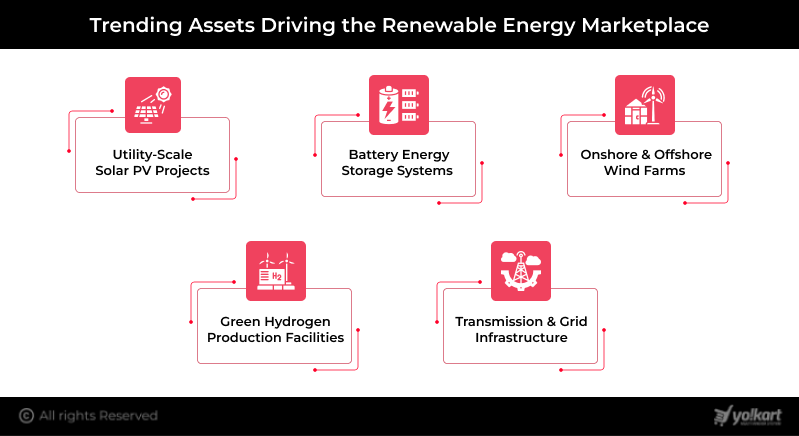

Trending Assets Driving the Renewable Energy Marketplace

To achieve strong organic traffic and sustain high transaction volumes, your marketplace must focus on assets that are currently dominating market growth. Given below is a list of some trending assets that drive the renewable energy marketplace:

1. Utility-Scale Solar PV Projects are large-scale installations of photovoltaic panels, typically mounted on the ground across vast areas. These projects are characterized by their capacity, often measured in tens or hundreds of megawatts (MW), and they are designed to generate electricity directly into the utility grid. These assets represent the most mature and widely deployed renewable technology globally, serving as a primary source of clean energy.

2. Battery Energy Storage Systems (BESS) encompass facilities that store electrical energy, most commonly through lithium-ion batteries, to be discharged when needed. Whether operating as standalone assets or co-located with solar or wind farms, BESS are crucial for addressing the intermittency of renewable generation. Their function includes grid stabilization, frequency regulation, and energy arbitrage (buying electricity when cheap, selling when expensive).

3. Onshore & Offshore Wind Farms consist of arrays of towering wind turbines that convert wind’s kinetic energy into electrical power. While onshore farms are widely spread across accessible terrains, offshore wind farms are increasingly being developed in coastal waters. The latter often offer higher capacity factors, producing power more consistently, and are critical for large-scale, baseload-type renewable energy supply, especially with emerging floating technology.

4. Green Hydrogen Production Facilities are industrial projects that use renewable electricity to power electrolyzers, splitting water into hydrogen and oxygen. The resulting “green hydrogen” serves as a high-potential energy carrier used to decarbonize sectors that are difficult to electrify, such as heavy industry, chemical production, and long-haul transportation. These assets are often considered high-growth, early-stage investment opportunities.

5. Transmission & Grid Infrastructure assets are the vital ‘Balance of System’ components required to support and distribute renewable power effectively. This includes high-voltage transmission lines, substations, smart grids, and advanced metering infrastructure (AMI). Investment in these assets is crucial for modernizing aging electricity networks, allowing them to handle the decentralized and variable nature of renewable generation.

Focusing on these high-demand asset classes positions a renewable energy marketplace to capture both near-term transaction activity and long-term growth.

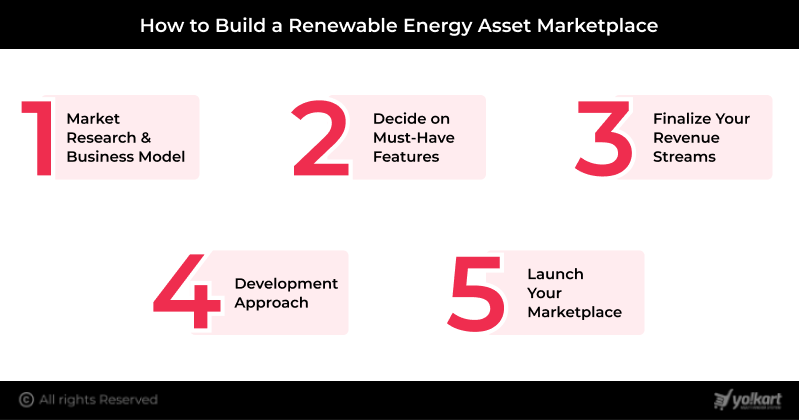

How to Build a Renewable Energy Asset Marketplace

Building a successful renewable energy asset marketplace demands careful planning, deep industry insight, and the right technology foundation. From asset listings to compliance and secure transactions, each component must support trust, scalability, and long-term growth. Let’s have a look at the essential steps to build such a marketplace:

Step 1: Market Research and Business Model

This step lays the strategic foundation of your marketplace. By identifying a focused niche and selecting the right transaction model, you define how value is created, who your core users are, and how your platform will differentiate itself in a competitive renewable energy ecosystem. Hence, you should:

- Define Your Niche: Will you focus on a specific asset class (e.g., fractionalized solar assets for retail investors) or a specific market stage (e.g., ready-to-build projects only)? Specialization reduces competition and simplifies compliance.

- Choose a Business Model: The primary model is Multi-Vendor eCommerce, but the specific transactions can vary:

- Asset Sale: Buying/selling physical plants or equipment, such as a 10 MW solar farm.

- PPA Trading: Facilitating contracts for the future purchase of energy.

- Fractional Ownership/Crowdfunding: Allowing multiple smaller investors to buy into a large project.

Step 2: Decide on Must-Have Features

Feature planning ensures the platform can support complex, high-value renewable energy transactions. From data-rich asset discovery to secure document sharing and financial analysis, the right features build trust, reduce friction, and enable informed investment decisions. Therefore, your platform must integrate the following feature-set:

| Feature | Why It Is Crucial |

| Advanced Search & Filtering | Enables users to efficiently filter high-value assets by critical parameters such as energy type (Solar/Wind/BESS), generating capacity (MW), project stage (Operational/Ready-to-Build/Development), and specific regulatory markets. |

| Complex User Role Management | Provides separate, customized administrative dashboards and permission sets for different user types, including Developers (Sellers), Institutional Investors (Buyers), and Asset Managers, ensuring secure and tailored platform access. |

| Document Management System (DMS) | Offers a secure, encrypted repository for Sellers to upload critical due diligence materials, including permits, Power Purchase Agreement (PPA) details, proprietary financial models, and engineering studies. |

| Financial Modeling Tools | Integrates in-platform calculators and analytical tools that allow Buyers to instantly model key investment metrics, such as Net Present Value (NPV), Internal Rate of Return (IRR), and Levelized Cost of Energy (LCOE), using standardized project data. |

| Secure Messaging & NDA Workflow | Facilitates private, confidential communication between interested parties and includes digital signing functionality to execute Non-Disclosure Agreements (NDAs) before sensitive project information is shared. |

| Audit Trail & Verification | Provides tools for transparently tracking all transactional changes and performance data. This often includes API integration with operational plant monitoring systems to verify asset performance and build investor trust. |

Create a Feature-Rich Renewable Energy Asset Marketplace

Step 3: Finalize Your Revenue Streams

A clear monetization strategy transforms your marketplace into a sustainable business. Diversified revenue streams tied to transactions, premium access, and value-added services help balance profitability while aligning platform success with user activity. Hence, some common revenue streams are given below:

- Commission on Transaction: A percentage (e.g., 0.5% – 2%) of the final sale price of an asset or the contracted value of a PPA. This is the primary revenue source.

- Subscription Fees (Premium Access): Tiered subscriptions for developers/investors offering enhanced features, such as early access to new deals, advanced analytics, and priority support.

- Featured Listings/Promotional Banners: Allowing developers to pay a fee to prominently display their projects or equipment to increase visibility.

- Value-Added Services: Charging for optional services, such as enhanced due diligence checks, legal template generation, or API access for performance data integration.

Step 4: Development Approach

Choosing the right technological foundation is the single most critical decision that determines cost, speed, and scalability. This step focuses on selecting a technology foundation that allows faster market entry while supporting customization, compliance, and long-term growth without excessive development risk. However, the two most popular approaches are custom development and Tailored solutions. Let’s analyze their pros and cons:

| Criteria | Custom Development | Tailored Marketplace Solution(e.g., Yo!Kart) |

| Approach | Fully custom-built platform from scratch | Tailored, configurable marketplace software |

| Pros | Unlimited flexibilityTailored featuresUnique UI/UX | Lower upfront costFast time-to-marketProven eCommerce marketplace foundationScalabilityOne-time payment |

| Cons | Very high development costLong timeline (12 to 24 months) Higher failure riskOngoing maintenance dependency | May require customization for niche needs, design follows core platform structure |

| Ideal For | Highly differentiated platforms backed by strong, secured venture capital | The most practical and cost-effective option for launching a robust, high-value renewable energy asset marketplace |

Recommendation: Given the need to focus resources on compliance, data verification, and user acquisition, leveraging a robust, proven, and scalable eCommerce marketplace software platform is typically the most strategic choice.

Step 5: Launch Your Marketplace

The launch phase focuses on credibility and controlled growth. Through asset verification and targeted industry outreach, you establish trust, refine workflows, and position the marketplace for scalable adoption across the renewable energy sector.

- Pilot Program: Invite a small, select group of high-profile developers and investors to test the platform with a few verified, real-world assets. Gather feedback and refine the user experience, especially around the core workflow and data presentation.

- Asset Verification and Onboarding: Establish strict, clear protocols for asset listing. Require all sellers to provide standardized data and documentation. A focus on quality over quantity is paramount to building trust.

- Targeted Outreach: Partner with industry associations, attend major clean energy finance conferences, and engage directly with infrastructure funds and corporate sustainability officers. Since the transaction value is high, a focused sales effort is more effective than mass marketing.

- Compliance Check: Before going fully live, ensure all transactional and data security aspects meet relevant financial and energy sector regulations in your target markets.

Things to Consider Before Building a Renewable Energy Asset Marketplace

Success in this highly specialized sector hinges on anticipating complex challenges that are both technical and industry-specific. Thus, careful planning at this stage can prevent costly mistakes later. A list of some important factors is curated below, which you must not overlook while building a renewable energy asset marketplace:

- Data Verification and Due Diligence: Trust is the foundation of every high-value transaction. Investors must be confident that asset performance data is accurate and verifiable. This often requires standardized data formats, detailed documentation, and integration with third-party verification or monitoring services. Therefore, a strong, data-driven due diligence framework is essential.

- Legal and Regulatory Compliance: Renewable energy assets sit at the intersection of finance and energy regulation. Moreover, you are dealing with financial transactions that often cross state or international borders. Thus, understanding securities laws, local energy market regulations, and Power Purchase Agreement (PPA) complexities is essential. Seek expert legal counsel from the outset.

- User Acquisition (The Chicken-and-Egg Problem): Every marketplace faces the chicken-and-egg problem means you need quality assets to attract investors, but you need investors to convince developers to list their assets. However, a successful strategy often involves securing a few reputable developers and an institutional investor before launch.

- Your Platform’s Cost, Scalability, and Management:

- Cost: A custom solution can easily exceed $500,000 to launch, while a software solution offers a predictable, one-time investment for the core software, minimizing Total Cost of Ownership (TCO). Additionally, most of the software solutions offer packages starting from $999.

- Scalability: The platform must be able to handle thousands of high-resolution documents, complex user workflows, and secure, high-volume transactions as your business grows.

- Management: The platform should be easy to manage for the admin/s, with intuitive dashboards for tracking listings, transactions, and user activity without needing constant developer support.

Yo!Kart: eCommerce Marketplace Software Solution

When building a complex platform such as a Renewable Energy Asset Marketplace, starting with a proven technology foundation offers a clear strategic advantage. Yo!Kart is a leading, self-hosted, multi-vendor eCommerce marketplace solution designed to launch high-performance marketplaces across various industries. It is a fully customizable and scalability software that allows entrepreneurs to tailor this robust software as per their business/industry requirements.

How Yo!Kart Can Help Build Your Renewable Energy Asset Marketplace

Yo!Kart is an ideal starting point for this specialized platform due to its core architecture and flexible customization capabilities:

- Multi-Vendor Architecture: Yo!Kart provides distinct, secure dashboards for Admin/Marketplace Owner, Sellers (Project Developers/Equipment Manufacturers), and Buyers (Investors/Corporates). This structure is essential for managing a B2B asset marketplace.

- Scalable Technology: Built with modern frameworks, Yo!Kart is designed to handle high traffic and a large product/asset catalog, offering the necessary foundation to scale your marketplace across regions and asset categories.

- Customization and Third-Party Integration: While providing a robust core, Yo!Kart offers 100% source code ownership and is designed for customization. This allows you to integrate specialized third-party APIs for:

- Financial Analytics: Integrating with financial modeling tools for IRR/NPV calculations.

- Data Verification: Connecting to energy monitoring systems to verify asset performance data.

- Legal Workflows: Adding digital contract signing (e.g., DocuSign) and secure data room functionality for due diligence.

Top Reasons to Choose Yo!Kart

| Feature | Benefit for a Renewable Energy Asset Marketplace |

| Separate Buyer/Seller Panels | Allows for tailored features, such as sellers focusing on listing projects with detailed specifications; buyers focus on due diligence and portfolio management. |

| Secure Payment Gateways | Pre-integrated with major payment gateways, including Stripe Connect, PayPal, and more, to securely manage large-scale financial transfers and automate commission splits. |

| PWA Compliance | Ensures a fast, smooth, and engaging user experience on desktop and mobile, critical for on-the-go asset managers and field developers. |

| One-Time Purchase | Eliminates recurring software licensing fees, offering a significant cost advantage over SaaS models and lowering the total cost of ownership. |

Take a Guided Demo of Yo!Kart

Conclusion

A Renewable Energy Asset Marketplace is more than a business idea. It serves as an essential piece of digital infrastructure for accelerating the global energy transition. By providing transparency, efficiency, and a digital connection point for complex, high-value transactions, these platforms unlock the capital required to build a sustainable future.

However, success requires a strong industry understanding of the energy sector, an unyielding focus on data quality, and a robust, scalable technological foundation. By leveraging a powerful and customizable eCommerce marketplace software like Yo!Kart and following a structured, industry-focused development plan, you can successfully launch and scale a highly profitable renewable energy asset marketplace in 2026.